Steering through the nuances of SR-22 and standard insurance can feel like a complex puzzle. While SR-22 serves a specific purpose for high-risk drivers, standard insurance offers a more traditional safety net. Understanding their distinct requirements and implications can greatly impact your choices. As you consider these differences, you'll uncover factors that could influence your coverage and costs in ways you might not expect. What might those factors be?

Key Takeaways

- SR-22 is a form for high-risk drivers, while standard insurance is available to all drivers without major violations.

- SR-22 requires continuous coverage reporting to the DMV, whereas standard insurance has less oversight.

- Premiums for SR-22 typically range from $2,000 to $5,600 annually, reflecting the high-risk classification.

- Lapses in SR-22 can lead to immediate legal penalties, unlike standard insurance lapses that only result in being uninsured.

- SR-22 filings confirm minimum liability coverage but are not insurance policies themselves, unlike standard insurance.

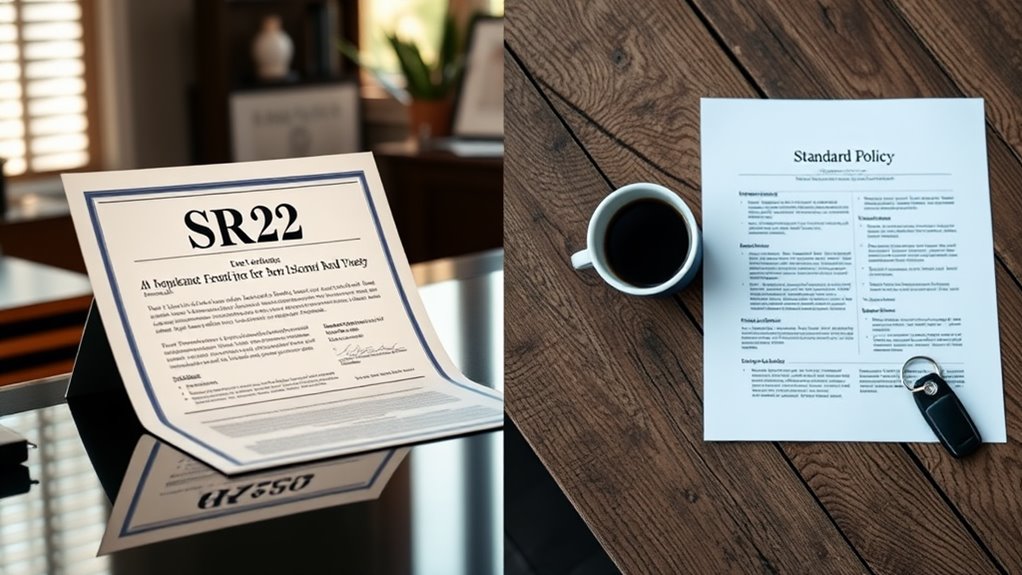

Purpose and Definition of SR-22 Vs Standard Insurance

When considering auto insurance options, understanding the purpose and definition of SR-22 and standard insurance is essential.

An SR-22 serves as proof that you meet your state's minimum auto liability insurance requirements, specifically for high-risk drivers. It's not an insurance policy but a form filed by your insurer, ensuring continuous coverage for drivers with serious offenses like DUIs. This certificate of financial responsibility is required to validate that a driver is maintaining their insurance coverage. In California, an SR-22 is typically required for certain serious offenses that can affect a driver's ability to obtain standard insurance.

In contrast, standard insurance offers broader coverage, including liability, bodily injury, and property damage, and is accessible to all drivers without high-risk conditions.

While SR-22 is mandated by most states for certain individuals, standard insurance policies don't require specific filings, providing flexibility and often lower premiums for the general driving population.

Understanding these distinctions helps in making informed insurance choices.

Required Coverage Differences

Although both SR-22 and standard insurance provide essential coverage for drivers, significant differences exist in their required coverage and regulatory frameworks.

SR-22 policies demand continuous coverage reporting to the DMV, which isn't required for standard policies. A lapse in SR-22 can lead to immediate legal penalties, while standard coverage merely results in being uninsured.

SR-22 requires ongoing DMV coverage reporting, unlike standard policies, where lapses only result in being uninsured.

Additionally, SR-22 is typically mandated for high-risk drivers following serious violations, ensuring the state monitors compliance closely. In contrast, standard insurance has minimal oversight unless associated with major incidents.

Both types offer liability, collision, and extensive coverage options, but SR-22's stringent requirements reflect its purpose of maintaining coverage for high-risk individuals, establishing a clear distinction in regulatory demands.

Cost and Premium Comparisons

The differences in insurance coverage directly influence the costs associated with SR-22 policies compared to standard insurance. SR-22 premiums typically range from $2,000 to $5,600 annually, considerably higher than standard rates due to the high-risk classification.

Filing fees for SR-22 can add an extra $15 to $50, with some states imposing additional fees for reinstatement. Monthly rates vary, starting at around $25 for minimum coverage but often exceeding $100 for full coverage.

Non-owner SR-22 policies may offer more affordable options. Regional variability is notable, with states like Wisconsin averaging about $1,643 annually.

Additionally, different insurance providers present varying rates, making comparison shopping essential for cost management.

Risk Classification for Drivers

Understanding risk classification for drivers is essential, especially when it comes to insurance policies such as SR-22 and standard coverage.

SR-22 typically applies to high-risk drivers, often due to severe infractions like DUIs or repeated traffic offenses. In contrast, standard insurance caters to a broader audience, offering coverage to those without significant driving violations.

This classification affects your premiums; SR-22 drivers usually face higher rates due to their elevated risk status. States mandate SR-22 filings to guarantee that high-risk drivers maintain minimum liability insurance, impacting your ability to reinstate driving privileges.

Ultimately, understanding these classifications can help you navigate your insurance options and find the most suitable coverage for your driving history.

Policy Administration and Reporting Requirements

Maneuvering through the complexities of insurance policies requires familiarity with both policy administration and the reporting requirements associated with SR-22 filings. Understanding these elements is vital, especially for high-risk drivers.

- Timely SR22 filings can prevent license suspension.

- Continuous coverage guarantees compliance and avoids penalties.

- Automated reporting enhances transparency and efficiency.

SR22 forms aren't insurance policies but essential documents confirming minimum liability coverage. Insurers must file these forms promptly, alerting the DMV of any policy lapses.

States have specific regulations regarding SR22 duration and the offenses that trigger its necessity. With automated filing and daily processing, insurers provide real-time updates on compliance status, emphasizing the importance of maintaining continuous coverage to avoid serious consequences.

Conclusion

In conclusion, understanding the distinctions between SR-22 and standard insurance is vital for any driver, particularly if you've faced serious offenses. While SR-22 guarantees compliance and accountability, its costs can be a shock. But what happens if you let your coverage lapse? The consequences can be severe. As you navigate these options, consider your driving history and future needs—because the choices you make now could have lasting impacts on your insurance journey. Are you prepared?